2025 Tax Credits And Deductions Worksheet. Updated for 2025 (and the taxes you do in 2025), simply enter your tax information and adjust your withholding to understand how to maximize your. Who must file, who should.

This publication discusses some tax rules that affect every person who may have to file a federal income tax return. While you may not be able to avoid paying all taxes, there are tax breaks that allow you to lower your 2025 tax bill.

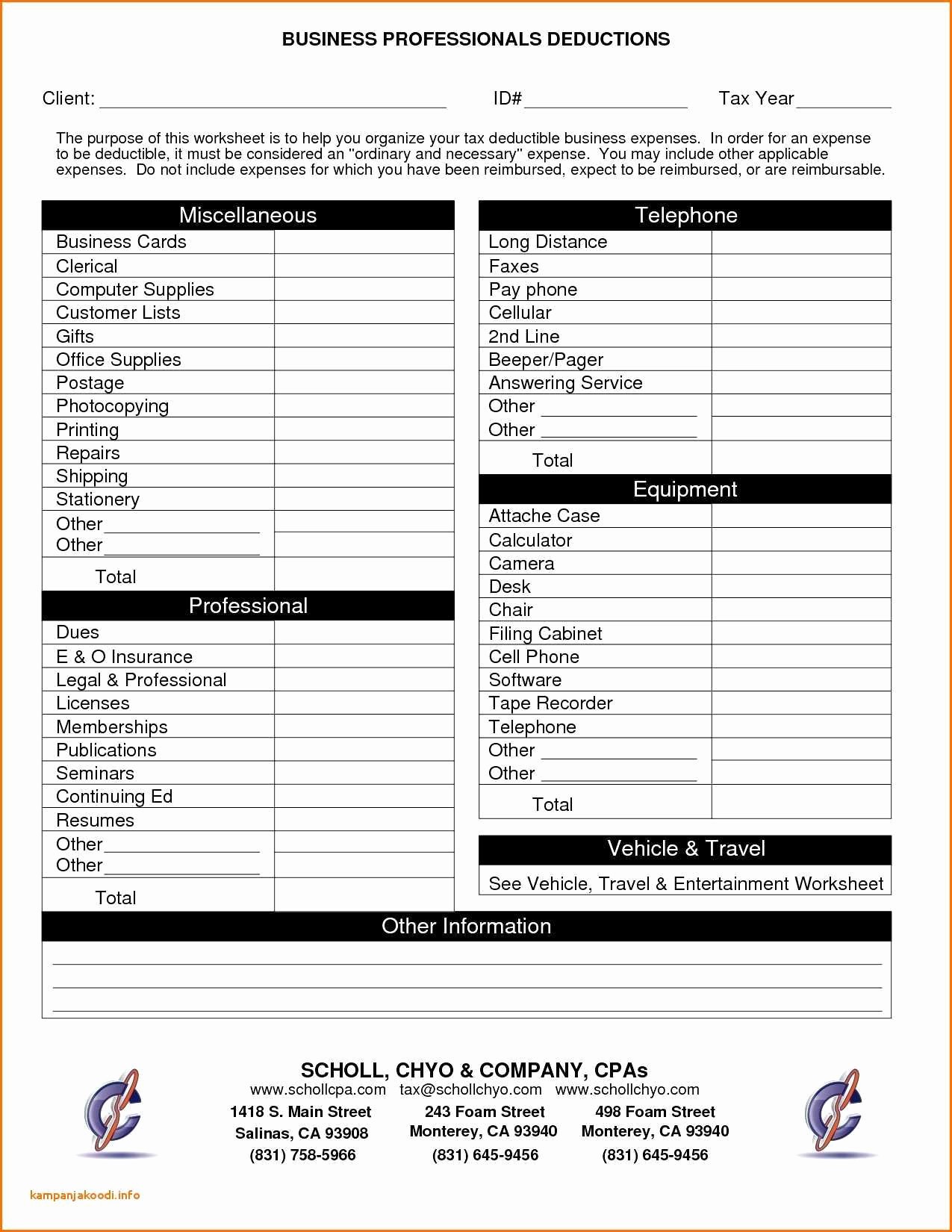

Small Business Tax Deduction Worksheets, Based on your projected tax withholding for the year, we can also estimate your.

2025 Tax Credits And Deductions For Seniors Nani Tamara, (eitc) the maximum earned income tax credit in.

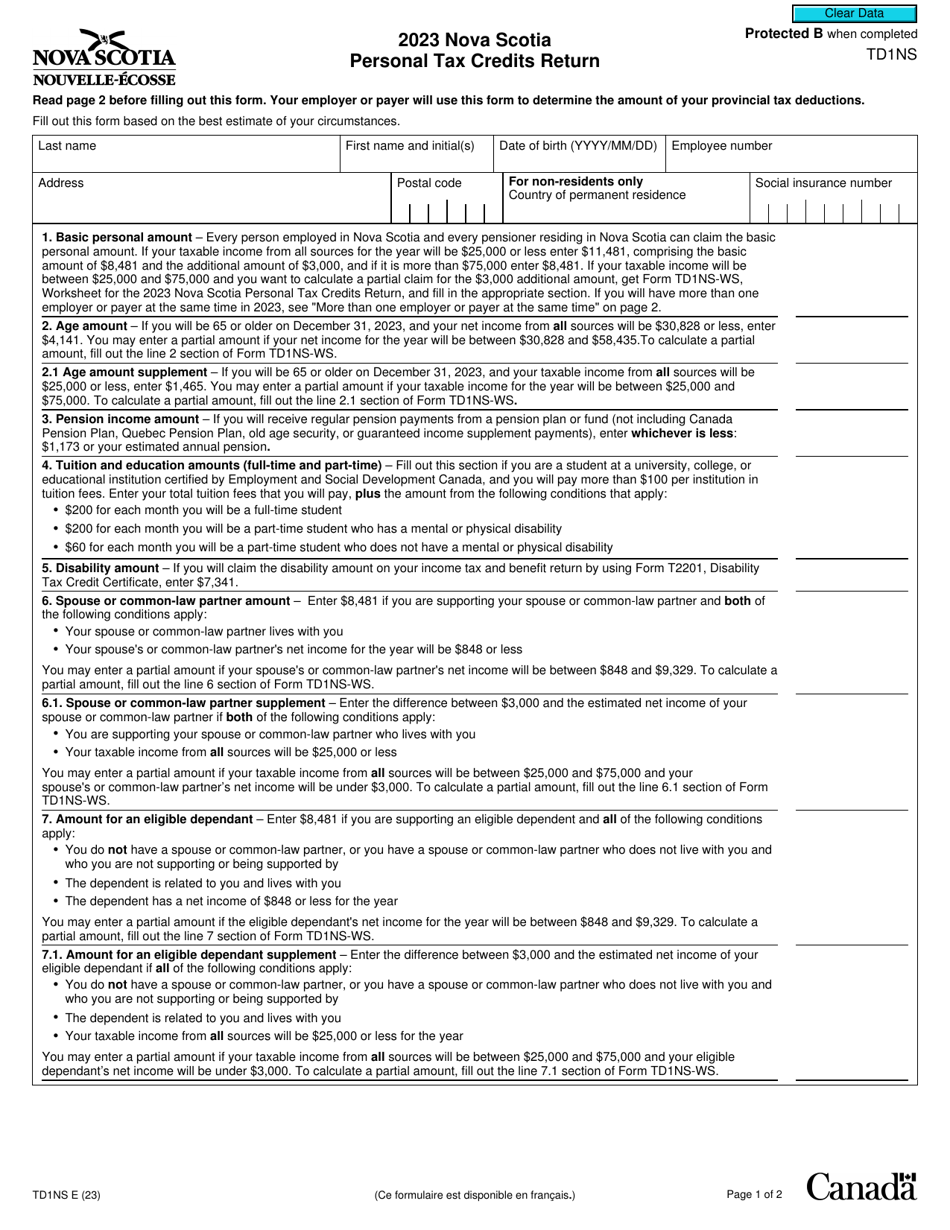

2025 Personal Tax Credits Return Dorena Hildegarde, Use this worksheet to figure the amount of your projected withholding for 2025, compare it to your projected tax for 2025, and, if necessary, figure any adjustment to the amount you have.

Are laundry expenses tax deductible, Can you claim Laundry on Tax?, This publication discusses some tax rules that affect every person who may have to file a federal income tax return.

2025 Tax Credits And Deductions Worksheet Sayre Barbette, Enter your filing status, income, deductions and credits and we will estimate your total taxes.

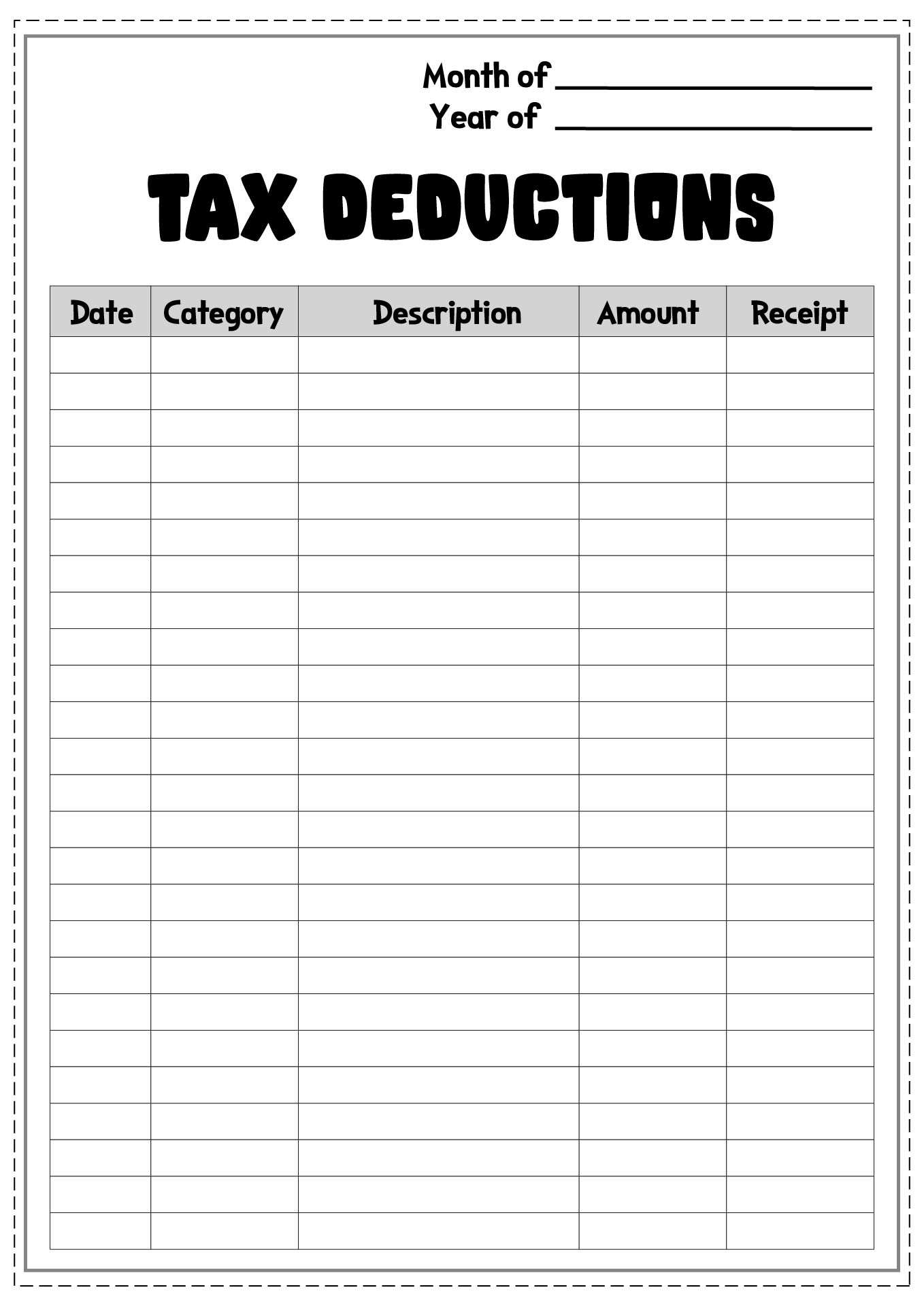

Itemized Deductions Worksheets, A deduction cuts the income you're taxed on, which can mean a lower bill.

2025 Tax Credits And Deductions Canada Ciel Melina, For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2025;

2025 Tax Credits And Deductions Married Jointly Alexi Austina, A deduction cuts the income you're taxed on, which can mean a lower bill.

Proudly powered by WordPress | Theme: Appointment Green by Webriti