How Much Per Kid For Taxes 2025. Make informed decisions for maximum savings. The government has a vision of providing housing for all and in line with this vision, section 80eea was also introduced in 2019 in the income tax act, 1961.

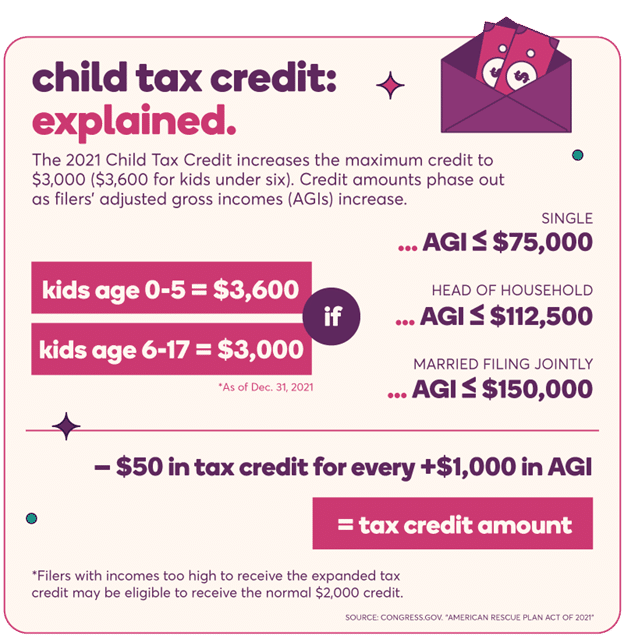

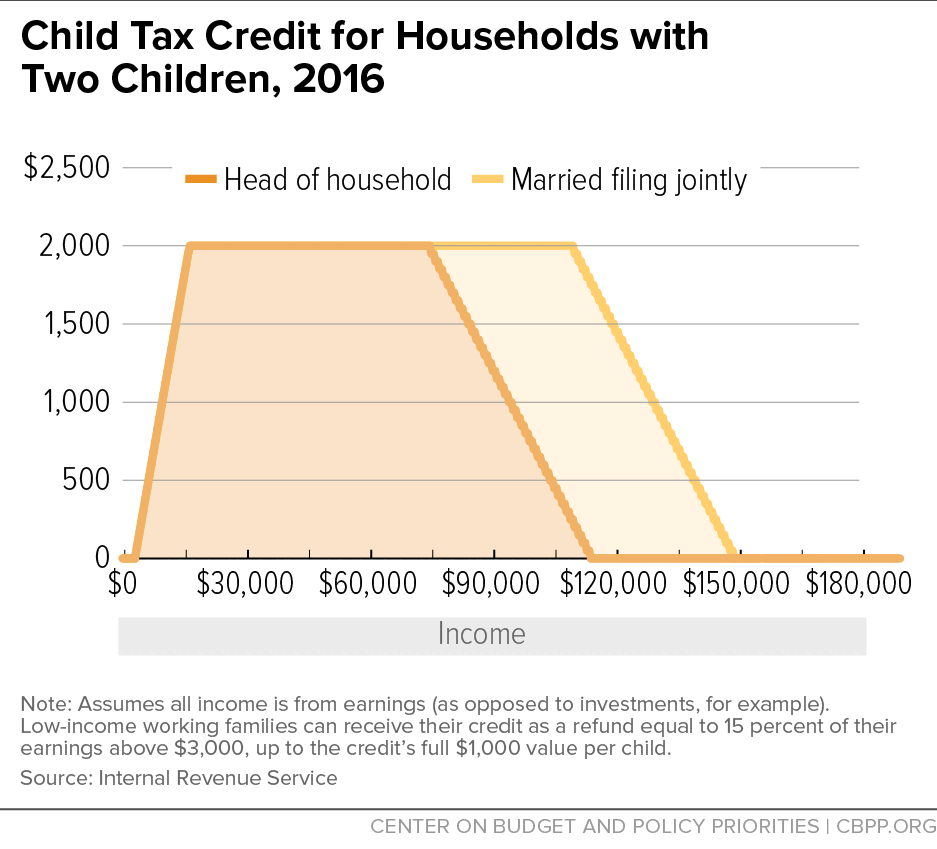

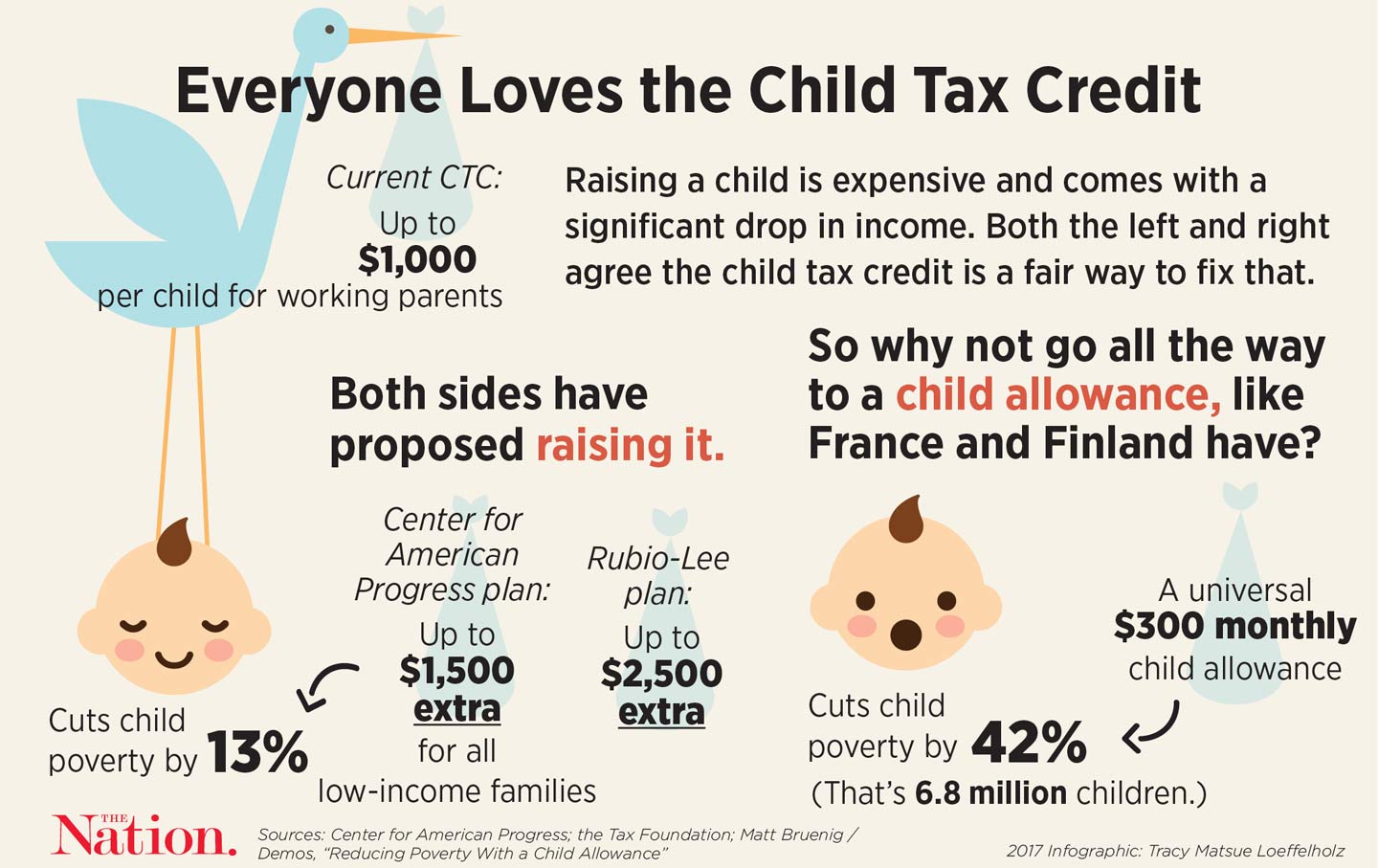

The child tax credit is limited to $2,000 for every dependent you have who’s under age 17,$1,600 being refundable for the 2025 tax year. Tax calculator and estimator for taxes in 2025.

The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all.

What Is Child Tax Benefit, This tax return and refund estimator is for tax year 2025 and currently based on 2025/2025 tax year tax tables. Tax calculator and estimator for taxes in 2025.

Child Tax Credit News Latest CTC updates and payment schedule, Plan your tax withholding, tax refund, or taxes due. As soon as new 2025 relevant tax year data has been.

T200018 Baseline Distribution of and Federal Taxes, All Tax, Tax calculator and estimator for taxes in 2025. Check steps to file income tax and know how much tax you must pay on your salary.

Child tax credit payments begin arriving today for almost one million, Individuals falling under the taxable. Plan your tax withholding, tax refund, or taxes due.

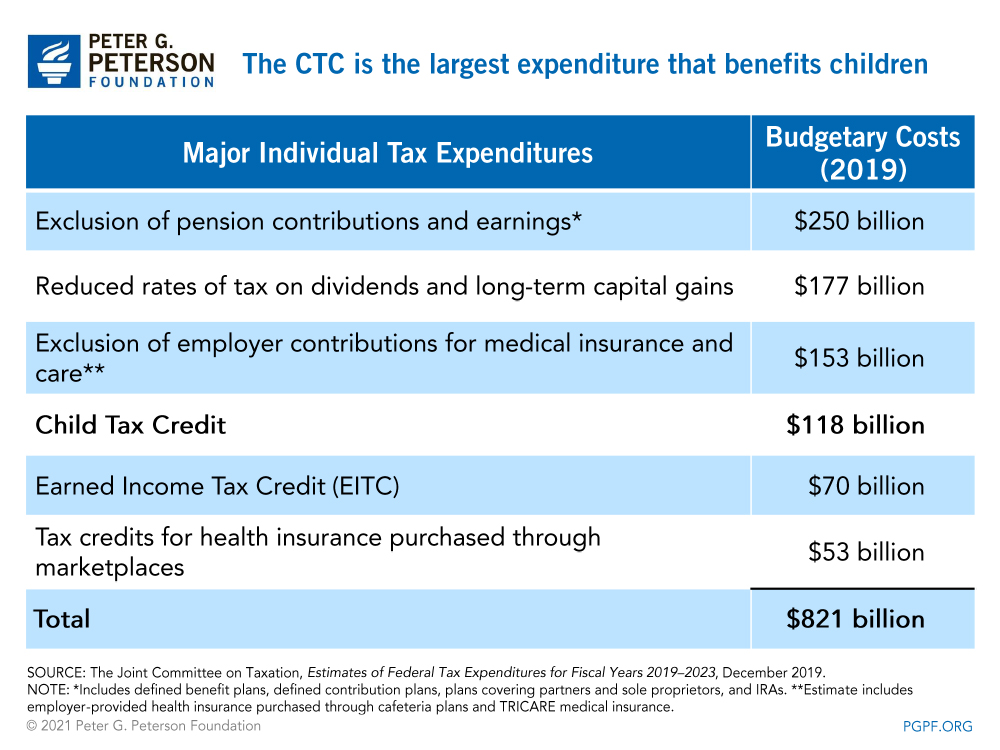

Benefits of Expanding Child Tax Credit Outweigh Small Employment, The class of ’53 library endowment fund currently has a book value of $70,836 and a market value of $99,196 with a projected $3,654 payout for. This tax return and refund estimator is for tax year 2025 and currently based on 2025/2025 tax year tax tables.

What Is the Child Tax Credit?, Finance minister of pakistan senator muhammad aurangzeb presented the budget wednesday in a tumultuous session of the national. Individuals falling under the taxable.

Democrats Further Effort to Expand Child Tax Credit for Pandemic Relief, Tax calculator and estimator for taxes in 2025. Make informed decisions for maximum savings.

Chart Book The Earned Tax Credit and Child Tax Credit Center, The government has a vision of providing housing for all and in line with this vision, section 80eea was also introduced in 2019 in the income tax act, 1961. Thanks to the american rescue plan, which was enacted in march, this year's child tax credit for many families is increased from $2,000 per child to $3,000 per.

How does the tax system subsidize child care expenses? Tax Policy Center, Make informed decisions for maximum savings. The income tax calculator helps in determining tax payable for a financial year.

File Child Tax Credit, You do not need to furnish any. Calculate your tax liability with new regime tax calculator, know how much tax you will have to.

The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all.